Explore

- Home

- About Us

- Services

- Blog

- Contact Us

Quick links

- Guide to Import

- Guide to Export

- ICEGATE

- DGFT

- Get DSC

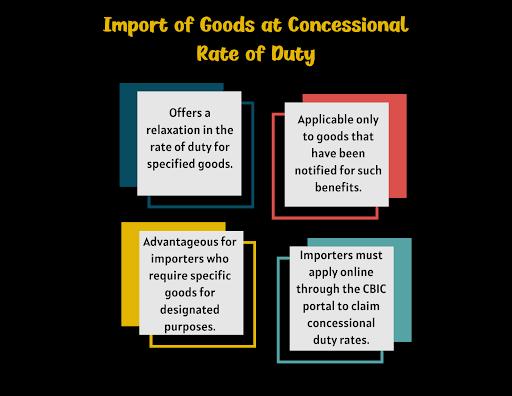

IGCR, which stands for ‘Import of Goods at Concessional Rate of Duty’, refers to a scheme implemented by the Central Board of Indirect Taxes and Customs (CBIC) that:

By adhering to the procedures outlined in the IGCR Rules, importers can take advantage of the concessions provided by Customs, facilitating the importation process for specified goods while ensuring compliance with regulatory requirements.

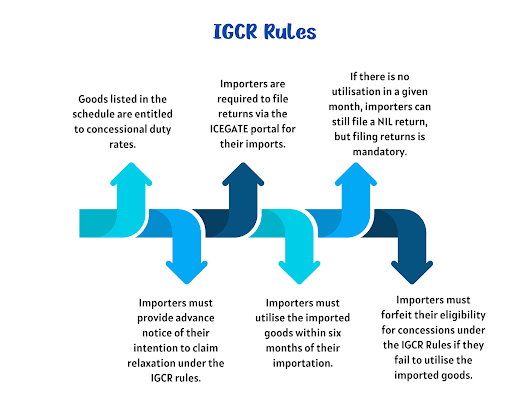

The CBIC administers the IGCR Rules, which delineate key terms crucial for their enforcement. Some of the guidelines outlined for importers under these regulations are:

The Customs IGCR Rules 2017, also known as the Customs (Import of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 2017, came into effect in India on July 1, 2017. These regulations:

The benefit of exemption is enshrined in the 2017 Rules as explained below:

The Customs Act, of 1962, under Section 25(1), delineates provisions concerning exemption notifications. The Act authorizes the Central Government to grant exemptions on customs duties for certain goods.

The notification for the same is provided if:

Additionally, Section 25(2) allows the Central Government, if deemed necessary in the public interest, to exempt specific goods from duty payment under exceptional circumstances. Such exemptions under Section 25(2) are granted through special orders, each case requiring justification of the exceptional circumstances.

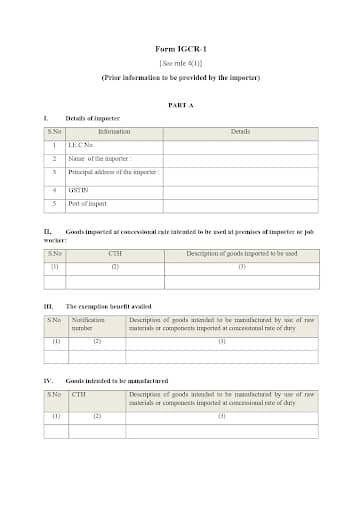

Importers seeking exemption benefits must inform the Deputy Commissioner or Assistant Commissioner of Customs at the location where the imported goods will be used. This notice should include:

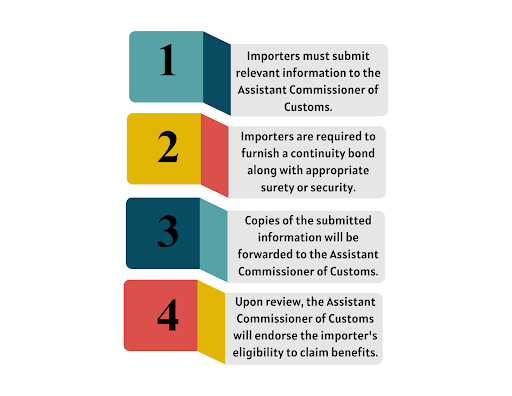

Here are streamlined instructions for importers to submit information to the relevant authorities:

Importers must submit relevant information to the Assistant Commissioner of Customs overseeing the area where the imported goods will be used. This information should include the estimated quantity and value of the goods, details of any applicable exemption notifications, and the port of import for each consignment lasting a year or less.

Importers are required to furnish a continuity bond along with appropriate surety or security. This bond should cover any potential duty differences on inputs, considering exemptions, along with applicable interest.

Copies of the submitted information will be forwarded to the Assistant Commissioner of Customs at the designated Customs Station of Importation.

Upon review, the Assistant Commissioner of Customs will endorse the importer’s eligibility to claim benefits under the provided provisions.

Beneficiaries of the exemption notification are required to maintain an account detailing:

These records must be provided to the Assistant Commissioner or Deputy Commissioner of Customs upon request.

Importers falling under this provision must submit a quarterly return by the 10th day of the quarter following the implementation of the provision.

Importers covered by these provisions have the right to re-export any unused or faulty goods provided:

The Rules of 2022 incorporate procedural measures aimed at ensuring that imported goods are utilized for their intended purpose as outlined in the relevant notification prescribing these rules.

Refer to the given link to access the 2022 Rules- https://www.salestaxindia.com/DEMO/TreeMenu.aspx?menu=208557

Some of the salient changes brought in by the 2022 Rules include:

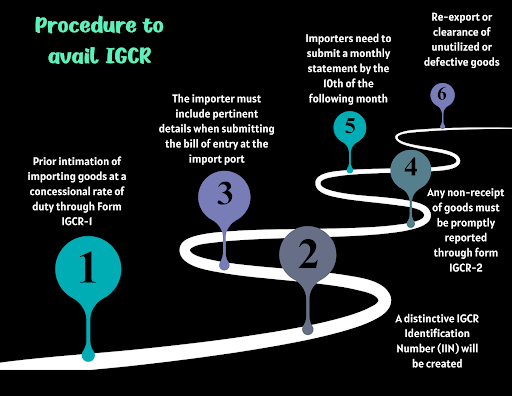

The steps that an importer must adhere to are outlined in The Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules of 2022, detailed as follows:

Rule 4 of the 2022 Rules mandates that prior information must be provided by an importer intending to import goods at a concessional rate of duty. This information must be submitted on the common portal in Form IGCR-1 and should include:

After the information is accepted on the shared portal, a distinctive IGCR Identification Number (IIN) will be created. This data will be accessible to the customs officer in charge of the relevant jurisdiction and to officers at the designated import port via the portal.

The importer must include the IIN and continuity bond number and details when submitting the bill of entry at the import port, as per Rule 5 of the Rules of 2022:

The Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules, 2022, address the receipt of goods in three situations:

The requirement to notify the receipt of goods has been eliminated in all these cases.

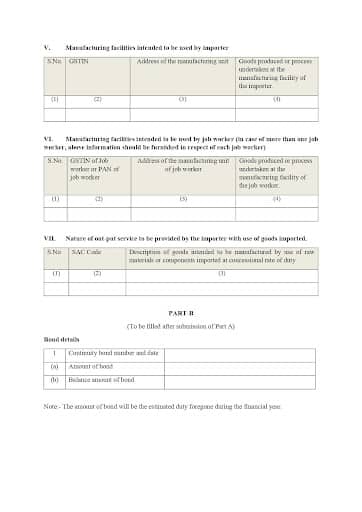

However, any instances of non-receipt or short-receipt of goods must be promptly reported by the importer through form IGCR-2 on the common portal.

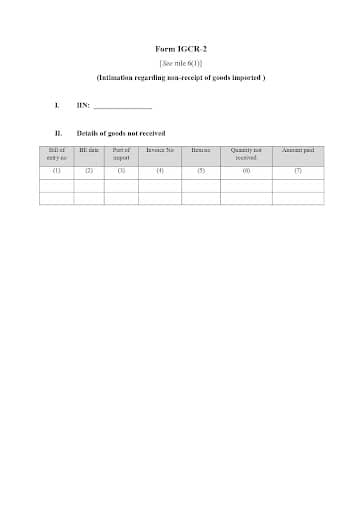

Under Rule 6 of the Customs (Import of Goods at Concessional Rate of Duty) Amendment Rules, 2022, importers now need to submit a monthly statement by the 10th of the following month via the common portal, using form IGCR-3, replacing the previous quarterly return requirement.

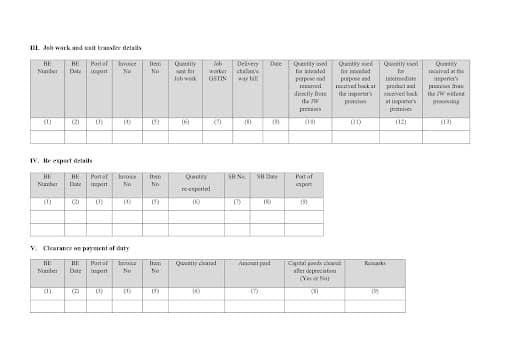

The importer is required to maintain an account pertaining to the goods imported. This account should detail:

When an importer decides to re-export goods, they must document export information including the shipping bill number, shipping bill date, and the port of export. These specifics should be associated with the bill of entry, invoice, and item details of the imported goods.

If the importer plans to clear unused or defective goods by paying the required duty and interest:

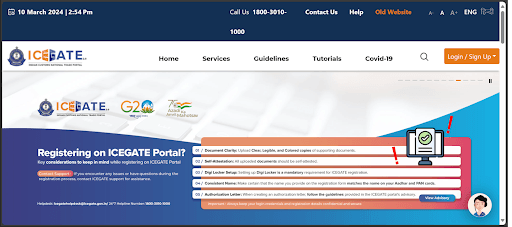

The Central Board of Indirect Taxes and Customs (CBIC) has introduced the Indian Customs Electronic Data Interchange Gateway (ICEGATE), an online platform designed for:

Through ICEGATE’s IGCR module, importers seeking concessions must provide advance notice by furnishing details of imported goods and their intended usage following prescribed guidelines. This streamlined process ensures transparency and accuracy in customs operations while facilitating smoother trade transactions.

Are you seeking a seamless and efficient process for importing goods at concessional rates of duty? Look no further! JPARKS INDIA offers the perfect solution tailored to meet your needs. Here’s why you should choose JPARKS INDIA for your IGCR:

Don’t miss out on the opportunity to optimize your import process under the IGCR scheme. Choose JPARKS INDIA as your trusted partner and experience the difference firsthand!

Contact us today to learn more about how we can assist you in importing goods at concessional rates of duty.

Importers, regardless of whether they possess a full-fledged manufacturing setup, a partially equipped facility, or none at all, are eligible to participate in this scheme.

IGCR offers the advantage of reduced duty rates, which are implemented by the CBIC to provide relaxation for certain notified goods.

The Import of Goods at Concessional Rate of Duty Rules, 2017, cater to importers seeking to take advantage of duty exemption benefits.

Icegate is significant because it enables customs to respond to importers and exporters after assessing Bills of Entry and Shipping bills. It also allows importers and exporters to easily track and view the status of their online documents.

In 2022, CBIC issued a circular regarding IGCR 2017. It offers clarification and guidance on its implementation. The circular addresses procedural requirements and provides extra guidance on documentation and accounting for importers benefiting from concessional rates under IGCR 2017.

The 2022 circular clarifies procedures for bank guarantees and bonds. It outlines documentation and declaration requirements for importers getting concessional rates. It explains the process for claiming an excess IGST refund. The circular offers guidance on valuing imported goods and calculating IGST under concessional rates.

If you haven’t used any imported goods in a month, you can file a NIL return for that month. Declare a lack of utilization by the 10th of the following month. Simply click the ‘Click to File NIL return’ button on the monthly return screen to submit.

The revised norms of IGCR now permit the import of Trimmings and Embellishments. Changes have been made to allow the import of Tags, labels, stickers, belts, buttons, hangers, or printed bags. Additionally, the import of lining and interlining material is now facilitated.

Yes, only Bills of Entry containing IGCR items mapped with valid IIN can be used for monthly return submission.

JPARKS INDIA Pvt. Ltd. aims to facilitate your application for an IGCR. Our team commits to aiding you in registering on the ICEGATE IGCR portal swiftly, typically within four business days. Feel free to explore our services through Google search or visit our website for further information.

EXCELLENTTrustindex verifies that the original source of the review is Google. Had a really good experience with JParks India. Rahul sir helped me a lot with my import work and were always active and responsive. Whatever documents or guidance was needed, they handled everything smoothly and explained things clearly. Felt stress-free throughout the process. Very helpful team, definitely recommend them if you’re doing import or export.Posted onTrustindex verifies that the original source of the review is Google. Quick & reliable servicePosted onTrustindex verifies that the original source of the review is Google. I took import consultancy services from Mr. Rahul at Jparks India Private Limited, and I must say he has excellent knowledge of the process. Really appreciate his professionalism and support. highly recommended!Posted onTrustindex verifies that the original source of the review is Google. very prompt and authentic services. team very responsive and courteous.Posted onTrustindex verifies that the original source of the review is Google. Wonderful Service and Very Fast. Love to recommend everyone. Thank youPosted onTrustindex verifies that the original source of the review is Google. I can get your import and export support in the future and I need it...I hopePosted onTrustindex verifies that the original source of the review is Google. Good service and posstive resposePosted onTrustindex verifies that the original source of the review is Google. Words fastest service for IEC Certificate and many for your Business They really understand client problem.Posted onTrustindex verifies that the original source of the review is Google. I found Mr Rahul Kolge quite professional & ethicalPosted onTrustindex verifies that the original source of the review is Google. Very Good and prompt response by the team and the work was completed in A day Appreciate itVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more